Challenges and Updates in Logistics and Transportation Industry

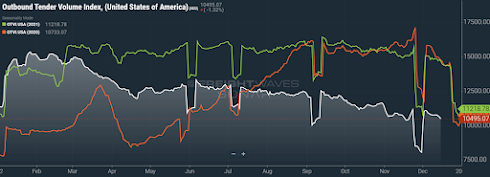

After emerging from the global pandemic, the logistics industry is facing new challenges. The year 2022 couldn’t outperform 2019 for the logistics companies and trucking industry. As a result, there is a big fall in freight demand in December 2022. Currently, the Outbound Tender Volume Index (OTVI) and Contract Load Accepted Volumes (CLAV) have decreased. On an average, the OTVI fell by 2.7% on a week-over-week w/w basis and 27.6% on a y/y basis. And CLAV has witnessed a dip of 2.7% w/w and 14.8% y/y. In December 2022, Ocean Imports also faced of the highest contraction in its history. In addition, shippers are giving fewer contracts to carriers, which is affecting the truckload volume negatively. At the time of the Lunar New Year, the absence of an increase in domestic manufacturing will further deteriorate truck volumes into 2023. What are the Current Issues Related to the Logistics Industry? Disruption in the global supply chain and port congestions are the current issues for the